Qwahn Kent - November 3, 2025

The custom home building market is experiencing a period of significant transformation. According to recent data from the National Association of Home Builders (NAHB), new home construction has remained volatile in recent years, with builders navigating fluctuating material costs, labor shortages, and shifting buyer preferences. Despite these challenges, the built-to-order segment continues to represent a substantial portion of new home sales, with approximately 20-25% of new single-family homes being custom or semi-custom builds.

Recent industry reports suggest that the average time from initial contact to signed contract in custom home building can range from three to six months, significantly longer than traditional home purchases. This extended sales cycle means that understanding and effectively addressing client objections isn't just important, it's essential for closing deals and maintaining healthy conversion rates.

But what are buyers actually concerned about when they're considering building a home? And more importantly, how are successful sales representatives navigating these objections to win contracts?

In the past, sales managers would rely on physical ridealongs and consumer surveys, which are limited by time and participation, to gain insights into buyer pain points and hesitations; however, Rilla, which records sales conversations between clients and reps, now allows managers to quickly gain customer insights leveraging our AI tools. For this analysis, we utilized one of those AI tools, Rilla Intelligence, to analyze thousands of sales conversations between home building representatives and prospective clients. We examined these recorded interactions to identify patterns in buyer hesitations and specific approaches that led to successful outcomes. Our analysis categorizes objections into major themes (i.e., financial concerns, construction and design preferences, location and environment factors), and then breaks down each category into subcategories that reveal the nuanced worries buyers express during consultations.

This exploratory analysis is intended to illuminate trends and patterns that emerged from real conversations. The following findings offer a data-informed look at the home building sales landscape, providing insights that can help representatives better understand their clients' perspectives and refine their approach to objection handling.

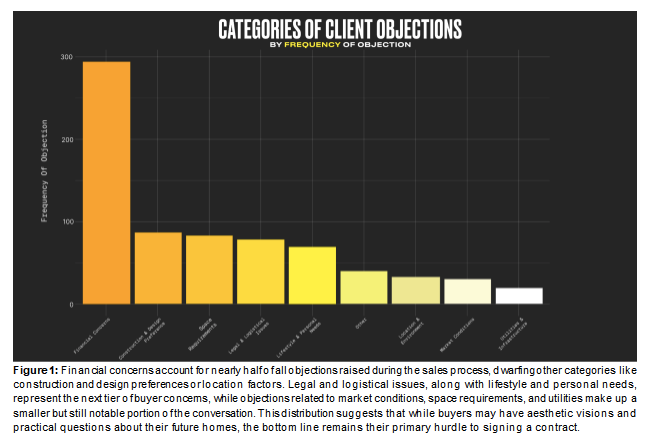

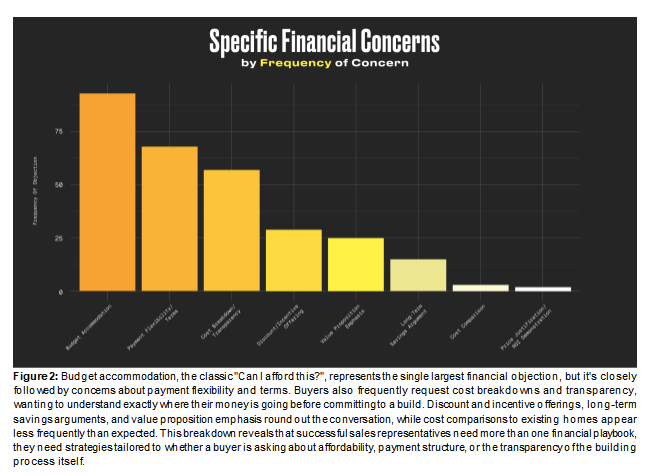

From the analysis above, we determined that the three most common objections that sales representatives experience during sales calls are Financial Concerns (40.1%), Construction and Design Preferences (11.73%), and Space Requirements (11.32%) (see Figure 1). Financial Concerns are overwhelmingly the most common objections salespeople face when conversing with potential clients. However, Financial Concerns is a broad category, so we distilled the objections relating to finance into several subcategories in order to provide sales professionals with the most detailed information, so they can prepare for the most likely objections. The most likely objections relating to finance that sales representatives are likely to face are budget accommodations (31.85%), payment flexibility (23.29%), and cost breakdown and transparency (19.52%) (see Figure 2). These are issues relating to budget constraints, financing options, rates, and payment structure, and transparency of pricing information, respectively.

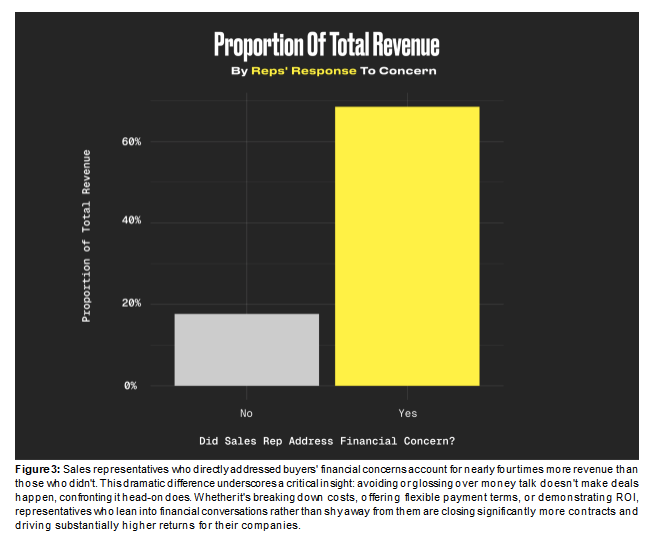

To further expand on the financial concern category and to compare between appointments where sales reps effectively addressed the client’s concerns and appointments where reps failed to address concerns, we looked at the total revenue generated by each approach. In 2025, we determined that when the financial concern was addressed the total revenue generated was $14.3 million, while not addressing the client’s financial concern resulted in just $3.7 million. This indicates that reps who addressed the client’s financial concern generated 4x more revenue for the year than reps who failed to do this (see Figure 3).

Takeaways

By knowing the objection categories that are likely to arise during sales appointments, managers and representatives can take the necessary steps to prepare for these objections, reduce buyer hesitation, and boost conversion rates. The majority of clients are going to express concerns with finances as the reason for not wanting to build a house, more precisely, their concern is going to be constraints with their budget. Sales managers should take the time to prepare their sales representatives for this type of objections as well as objections pertaining to the other major objections. This can be done by briefing sales reps on financing options the company and banks may provide for future clients, building options that cater to different budget categories, and generally how financial limitations can be worked around. Sales representatives can prepare to counter this concern by clearly explaining financing options and exaggerating the desire to work within the constraints of the client’s budget. While financial concerns are by far the largest objections, sales representatives should still be prepared to tackle a broad range of concerns to quell the clients apprehension surrounding the investment of purchasing a home.

Many of the leading home building companies like Red Door and Tilson are beginning to recognize the value Rilla provides to their sales teams with some companies seeing an increased close rate of 10% in just one month. Rilla and our AI tools allow managers to use recorded customer conversations to effectively scout client pain points, provide game plans for sales reps, and coach from the sidelines. Book a demo with Rilla today to see just how much we can boost your sales and to gain access to AI tools like Rilla Intelligence to conduct analyses similar to the one above.

References:

National Association of Home Builders. (2024). Housing Market Index and Builder Confidence Reports. NAHB Economics and Housing Policy Group.

National Association of Home Builders. (2024). Single-Family Home Building Production Statistics. NAHB Research Center.

Metrostudy. (2024). Custom and Semi-Custom Home Building Trends. Hanley Wood Market Intelligence.

HomeBuilder Digital. (2024). The State of Custom Home Building: Sales Cycle and Buyer Behavior Analysis. Industry Research Report.

Builder Magazine. (2024). New Home Sales Process: From Lead to Close. Hanley Wood Media.